You filed a Chapter 7 Bankruptcy and all debts were discharged. You selected not to reaffirm mortgage(s). You have continued paying on your mortgage(s) and now you want the payments reported on your credit report. With one exception that is not going to happen. The fact is that there is but one permanent way to get your mortgage payments reported on the credit reports and that is to refinance your mortgage, when possible. When your bankruptcy was discharged, the Promissory Note portion of the mortgage was legally eliminated. As a result, the mortgage payments will no longer be reported to the credit reporting agencies. Consumers, for obvious reasons, cannot self-report their credit history. For further information as to why the bank or mortgage company doesn’t report your payment, refer to an earlier post I wrote on this subject.

How To Get “Credit History” For Your Mortgage Payments In Order To Refinance

How can you refinance when your present mortgage servicer does not credit report your mortgage payment? There are a couple of ways to do this. The least expensive is for you to obtain proof of your mortgage payments for the past twelve (12) month and provide this to your mortgage broker. A temporary way to pull the mortgage payments onto the credit reports is via a proprietary system such as Rapid Rescore which is available only to mortgage brokers. Your mortgage payment history can be pulled onto the credit reports for the purpose of mortgage refinance by a mortgage originator in cooperation with a credit reporting service through a credit rescoring system. This is a temporary fix only; a bridge to refinancing once all other factors are in place. The only permanent way to get your credit report to reflect your mortgage payments is to refinance if and when you are eligible.

How To Qualify For Refinance After Chapter 7

- You have been paying your housing expenses [rent or mortgage(s)] on time every month for at least the last 24 months – in rare circumstances, 12 months.

- There have been no 30 day late payments on your mortgage(s) since filing bankruptcy.

- The CAIVRS Authorization system provides a clean report regarding default on an applicant’s past Federal government loans or guarantees.

- Your current taxable income as well as that of the past two years proves you can pay your mortgage and your debt ratio is acceptable to the lender.

- The taxable income used to qualify for the home loan will continue for a minimum of three years.

- You did not have a junior mortgage prior to filing or it is also current with no late payments or see (*) below.

- No other real estate was included in your bankruptcy or was foreclosed, short sold or surrendered such as investment property or second home within 4 years.

- You have no new bad credit whatsoever and no open credit disputes.

- Your present property value is 10% greater than what you owe on your mortgage(s), i.e., the house can be sold to payoff the mortgage(s), in full, including the cost of sale.

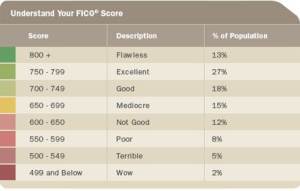

- You have minimum 700 middle FICO® Score (not FAKO scores). To get an idea of your score range use the FICO® Score Simulator (garbage in = garbage out).

- All borrowers must have established new good credit and exhibit that they are managing it very well.

- If the property is a Condominium, it must be FHA approved for FHA home loans or VA approved for VA home loans.

Investor Overlays

Investor overlays are measures lenders take to manage risks. You may need to shop around as, some lenders require 36 months from the Chapter 7 Discharge. Most lenders require higher credit scores, say in the plus 700 range before considering a new loans. The higher the FICO® Score, the better the rate and the lower the cost of the rate will be offered. There is much more to be discussed on the subject of lender overlays

Reaffirmation Is Not Necessary To Refinance

If your mortgage lender/servicer/bank insists that the mortgage must be reaffirmed, you simply need to call on a more seasoned mortgage banker or broker. There are those who will tell you that you must reaffirm the debt. Neither your attorney or I would recommend doing this; nor should you, in any case, do so without seeking the advice of your bankruptcy attorney. Keep in mind that the reaffirmation must be done prior to the Discharge and that is only your bankruptcy judge that can approve a mortgage reaffirmation – my understanding is that many will not.

Readers of this blog most often read Credit Union Power and New Credit During And After Bankruptcy too.

(*) The junior or second mortgage lien was legally stripped from the property in the bankruptcy. Note: this is a very, very rare circumstance. Another option is: the mortgage has been settled, such as via a short payoff in which case a further time-out period may be required.

Financially Speaking™ James Spray, MLO, CNE, FICO Pro CO LMO 100008715 | NMLS 257365 | January 12, 2012 | Revised October 5, 2014Notice: The information on this blog is opinion and information. While I have made every effort to link accurate and complete information, I cannot guarantee it is correct. Please seek legal assistance to make certain your legal interpretation and decisions are correct. This information is not legal advice and is for guidance only. You may use this information in whole and not in part providing you give full attribution to James Spray.

Very informative post. After filing bankruptcy the most common mistake done is that we don’t let know about our mortgage payment to creditors. We must let them know as it will help to get credit in future.

LikeLike

James,

Little wrinkle. I purchased a 2 family house in 2004 and lived in it at the time I filed Chapter 7 in 2006. The FHA note was discharged in connection with the Chapter 7 in 2006. I have since relocated to another city and currently rent the 2 family house. I have never missed a payment. I contacted Wells Fargo (mortgage servicer) about a streamline refinance (I have equity in the 2 family house and wish to refi to lower my payments). WF says I need to reafirm the FHA note on the 2 family inorder to obtain a streamline refi. Does your follow-on statement (above) mean I just need to contact another FHA lender inorder to avoid reaffirmation and still be eligible for a streamline refi (I stress the property is no longer my principal residence and I rent it).

LikeLike

Good questions, Jay. Wells Fargo (WF) is not going to refinance you unless you reaffirm which I would not advise even if you could. While not an attorney, I do have a good laypersons understanding of the machinations of Bankruptcy regarding reaffirmation post-discharge. [1] You likely cannot at this date officially reaffirm. Let’s say for argument purposes that you could get over this very tall legal hurdle and I am not saying it’s possible – you would wish to get a written guarantee from WF with the only contingency remaining being the approved reaffirmation. You would wish to have a real estate attorney that has a strong knowledge of bankruptcy law approve this written guarantee from WF. [2] While WF may allow you to reaffirm to their standards, I do not adivse that you so do. [3] You may now be able to modify the mortgage with WF to lower the interest rate or lengthen the term to lower the payment. [4] Given this is an FHA mortgage, there is a FHA case number associated with the property address – because of this, no other FHA lender will refinance this loan. The best you can do is modify. [5] FHA does not make or insure investor loans so modification may no longer be an option.

Finally, please realize that as long as this property remains in your name you will not be eligible to purchase another property for a minimum of three years following the disposition (sale/short sale/foreclosure) of this property address. For more information on this subject visit my blog titled Zombie Mortgages (10/01/2012).

LikeLike

Can anyone please help me figure this out? I filed for chapter 7 and it was discharged in 2001. I purchased the house in 1999 but my bankruptcy lawyer never completed a reaffirmation form for my mortgage. Now, after 11 years of paying my mortgage on time, I am being told I cannot use the FHA streamline refinancing because a reaffirmation was not done 11 years ago. Is this possible? Is this a FHA rule? or is Wells Fargo giving me the run around because they want to keep me on the 7% interest rate?

Frustrated in Lithia Springs, GA

LikeLike

Dear Frustrated in Lithia Springs, GA:

First, be not so hasty in blaming your bankruptcy attorney for not scheduling a court hearing so you could reaffirm your discharged mortgage note. I am sure you undestand the laws concerning bankruptcy and reaffirmation are not meant to be casual. Bankruptcy is a really big deal. Reaffirmation is a really big deal and many Bankruptcy Judges in some Districts will simply not approve a reaffirmation under any circumstances. My understanding is that reaffirmation must be done prior to the Discharge. In all events, that was then and this is now.

Do understand that you cannot do a FHA streamline because the mortgage note is legally dead. You are not entitled to refinance a dead mortgage note. Reread the blog to which you responded and then seek a mortgage professional in your area that understands how to deal with that which I’ve written. HINT: Said individual will not be one that works in the front line of any bank or credit union. When you find such a seasoned mortgage origination professional (15+ years experience), please feel free to share my blog with that individual. For additional information, I suggest you read my blog of 10/01/12 titled Zombie Mortgages.

Best wishes for your success!

Jim

LikeLike

Thank you for the info. I read your blog titled Zombie Mortgages. Unfortunately, I determined that my mortgage statements do show a message about the bankruptcy. I never noticed this due to on line billing and payments. Does this mean that Wells Fargo can step in and take the house whenever they choose??? I am really concerned about this, especially if I am unable to get it refinanced. I will make some calls on Monday and try to figure something out. Can you recommend any lenders? Thanks again.

LikeLike

So long as you make your payments (and keep a paper trail of your payment history to prove such if need be) the mortgage servicer (presently Wells Fargo) cannot step in and take the house whenever they choose. The only way the servicer can take the house if through the legal process of foreclosure. Though not an attorney, this protection is provided for you through the Bankruptcy Code. You elected to retain and pay and this is your right.

Given your statement contains the word bankruptcy, my suggestion is that you work with Wells Fargo to obtain a loan modification. Once you have the loan modification (think positive) it is quite possible the mortgage statement will no longer have the “B” word. The “B” word by itself on your statement will keep any other lender from doing a refinance.

For additional information on loan modification I suggest you closely review this information: HAMP”>

For assistance on applying for a loan modification, talk with a HUD Certified Housing Counselor. BE VERY CAREFUL. There will be those that tell you you must quit making payments for several months to qualify for a loan modification. You do not need to miss payments to get a loan modification if you qualify for a loan modification. Loan modification costs you nothing. If someone wants to charge you an up-front fee, this is the first clue you are dealing with a crook. Hang up. Move on to an honest counselor.

Best wishes for your success!

Jim

LikeLike

I love the feedback provided to everyone. I filed Chapter 7 in February of 2012 and debts were discharged in May, 2012. I only reaffirmed my car and not my co-owned mortgage through Wells Fargo. I was not familiar with the concept of reaffirming the car, house, etc.. The attorney automatically submitted the paperwork to reaffirm my vehicle but excluded the mortgage. Just recently, I found out that WF records shows the house as being included in the Chapter 7 filing. I was very confused as to why my attorney did not reaffirm my mortgage. The house is co-owed, so my boyfriend is not very happy.

We wanted to try to lower our payments through some type of modification program. Would that be HAMP?

Are we able to apply for a modification even if the home was not reaffirmed? I feel horrible that my Chapter 7 has not affected my boyfriend too.

Your advice or guidance would be great!! THANK YOU!!!!

LikeLike

Hello Doris –

You may be able to modify via HAMP, depends on if your loan is HAMP eligible. For more info on HAMP go to the official Making Home Affordable website and read up on your options per HAMP. Start with the “Get Started” feature.

Another blog to read on this subject is: Miranda Warning for Loan Mods and Short Sales

In the event you are not HAMP eligible, ask your loan servicer to help you modify your loan if possible. Keep in mind not everyone an not all mortgages qualify for a loan modification. The need of such must be established. Final word of caution, if someone tells you that you have to miss payments in order to qualify for a loan modification, you are talking with an idiot. I do hope you will not listen to such idiotic advise.

Best wishes for your success.

Jim

LikeLike

Hi Mr. Spray,

Very interesting and educational information. I have to present our case here since you are very familiar with Bankruptcy Ch 7 and reaffirmation of mortgages.

We Filed Bankruptcy Ch 7 3 years ago in Arizona. We reaffirmed our car but never received a reaffirmation for the mortgage (PNC never returned the documentation acording to our lawyer). We loved our house and continue making payments since our intention was to keep the house. My husband job was gone after our bankrupcy process to add to the stress. We tried to modify the loan and PNC mortgage company told us that we didnt qualify since we have never been late on payments. We did fall behind since our funds were limited. After falling behind , still they didnt work qualified us for the modification loan and forced us to pay $1,000 extra…(yes, our regular monthly payment PLUS $1,000) every month to avoid foreclosure for the next 24 months until we got cut-up with P&I late fees plus their lawyer fees for the foreclosure paperwork they have initiated. We went through amounts of huge stress to make the crazy monthly payment to retain the house. We have been back to regular payments since October 2012 but payment keeps increasing since property taxes and insurances keep going up. Now, the house’s foundation is cracked all along the slab and its causing structural damage that will cost a fortune to fix. The home insurance does not cover since it is due to Dirt Movement and Flood Plains. We have tried to get a loan modification but PNC is not willing to work with us. We are upside down and our mortage payment is high…cant afford to get a loan to fix it since the cost will be a mnimum of $50k. We started a process to refinance to get lower payment in an effort to reduce the monthly payments at a lower interest rate. Another mortgage company told us that we didnt qualify since the Mortgage was not reaffirmed and we were late on one payment during the 24 crazy monthly payments (2 days late)…its when we found out that we never reaffirmed with PNC and that they are reporting our payments to the credit bureou. Couriosly, PNC (same mortgage company) is willing to refinance. We started the process to refinance until I read all about the bankrupcy and reafirmation on your blog. Can we walk away since at this point without being liable to PNC since they may not be able to sell the house due to the cracks and investment required? Not even the love for our beauitful house can help with the feeling of the house falling apart (cracks on walls, ceilings, and foundation) We did receive a $800 check for the wrongful foreclousure practice – check was received about 2 months ago – A class suit. Our plan is to save half of the payment leasing a smaller house and re-apply for a mortgage loan in 7 years from now, is that possible? Whar are the risks and traditional process if we decide to walk away now?

Thank you for your time and dedication to this matter.

– Ms. M

LikeLike

Dear Ms. M –

I am confused by one of your comments. On one hand you state you did not reaffirm the mortgage with PNC and on the other you state, “[PNC is] reporting our payments to the credit bureau.” If PNC is, in fact, reporting your payments or any missed payments to the credit bureau(s), I am led to believe one of two things. Either the Discharged Promissory Note (Note) was reaffirmed or PNC is attempting to collect a Discharged debt. It can’t be both ways. If PNC is, in fact, reporting your payments to the credit bureau(s) it is likely that you did reaffirm. You need to obtain proof of the credit reporting by PNC. Start by getting your credit report from http://www.annualcreditreport.com or call 1-877-322-8228. Next contact your former bankruptcy attorney and ask if you can hire him/her to help you get clairification.

On the other hand, if you did not reaffirm, your attorney likely told you that you would always have the option of “walking away” with no further negative repercussions from the Note. Perhaps your attorney can assist you with negotiating a Deed-In-Lieu of foreclosure (DIL).

In any event, there must be a resolution to the Trust Deed (Deed) which went along with the Note to create the mortgage on the property. When you were Discharged from bankruptcy the Note was Discharged. The Deed however lives on and is recorded with the county clerk and recorder. The Deed is what will hold your recovery back. It is only when your name(s) are no longer on the Deed that your recovery begins. If you can get a Realtor to help you short-sell the property there will be a date certain when your name(s) will be removed from the Deed.

If you allow the property to simply foreclose, once the foreclosure occurs, your name(s) will be removed from the Deed. The problem with this scenario is that you cannot force PNC or any other mortgage servicer to foreclose.

For the time out of the mortgage market from any of the above scenarios, refer to: . The good news, it if you can arrange for a DIL or Short Sale your time out is only 3 years.

Best wishes for success!

Jim

LikeLike

Hi Mr. Spray,

I found this post and the post on zombie mortgages very informative. My husband and I declared Chapter 7 three years ago. We had bought our home one year prior to the bankruptcy so it was included in the discharge. We never reaffirmed the debt. We have never made a late payment on the mortgage. Wells Fargo is not reporting to our credit. Our credit is now in the 670s. We decided recently to try and refinance. The mortgage broker we spoke with said it would not be possible for us to refinance, unless we reaffirmed the debt. Our decision had been (before I read your posts) was to sell the house and buy a new one, if we weren’t able to refinance. However, after reading your posts this doesn’t look like a possibility either. What do you think would be the best option to take? Is it possible to in fact refinance our home at this time? Also is there anyway to sell our house without it adversely effecting our credit? If we were to allow the home to go into forclosure how long would it be until we would be eligible for a new mortgage? I wish we had known about this prior to filing. We would have either reaffirmed the debt or we would have let the house go at that time.

Thanks so much,

Anna

LikeLike

Hello Anna –

I think you understand that if your mortgage is insured by FHA, VA or USDA you can refinance. If not so insured by a government agency, refinance is not an option. If you are able to sell your property and it is not a short-sale, you may be able to purchase another property with a government insured loan now. If the sale must be a short-sale or the property has to be foreclosed* you will be out of the mortgage market for three years. During the time out, you will wish to study my blogs on rebuilding your FICO Score to above 700 or better yet, 720.

Best wishes for success!

Jim

* Banks and mortgage companies often drag-out a foreclosure out for months or even years and years. So if you determine that allowing foreclosure, you will certainly want to try to negotiate a deed-in-lieu (DIL) of foreclosure to get a date certain for you name to no longer be on the property so you can move on. If the DIL is the way for you to go, get a real estate attorney to help you.

LikeLike

My Chap 7 was discharged 2 1/2 years ago. My credit score is over 660. My LTV on my house is 77% (I know it’s unusual). I do not have any late payments. I live in AZ. I have gone to my bank, WFB, and two mortgage brokers, one which my BK attorney suggested, and all are saying I need to reaffirm my loan first. All I’m trying to do is lower my interest rate. Any suggestions on a mortgage broker that doesn’t require a reaffirmation?

LikeLike

Doris – As you noted by reading my blog, if your mortgage is government insured you have an option to refinance. If it is not FHA, VA or USDA insured, there is no ‘cookie cutter’ mechanism available for refinance. Also, I suspect you may not be able to reaffirm a Discharged mortgage in a case that has been Discharged and presumably closed. On this, you will wish to speak with your attorney to see how much if would cost to reopen your case to reaffirm and if that is even an option.

Best wishes.

Jim

LikeLike

Jim,

My wife and I married in 2009, and filed Chapter 13 in 2010 due to job loss. In the 13 my home was forclosed on, and we eleced to keep my wife’s home. Her mortgage was payed outside the payment plan to the trustee and has been and remains to this day, current and never late. In 2012 we converted the Chapter 13 to a Chapter 7, again due to a job loss and medical issues dratically impating our ability to pay the trustee. Again, my wife’s mortgage was paid on time during this period, and remains current to date. The Chapter 7 discharge was obtained in in June, 2012, and the mortage was not reaffirmed (which was confusing to us, as it our mind it wasn’t included in the original Chapter 13 payment plan), and B of A hasn’t reported payments to the credit agencies sine the original filing.

The mortgage was originally obtained through Countrywide, and purchased by B of A, it is a 10 year interest only at 6.85%, with the payment increasing approximately $300 a month in 2014. It wasn’t FHA, VA, of USDA insured, and based on my calculations, I’m not really sure how she obtained the financining to begin with, as her income ratios at the time didn’t work, and there was really little hope they would chage the dramitically in 10 years (thought was property values would continue to increase, and a refince would occur before reset). There is no second on the property, nor was one stripped during the BK. While property values plummeted here in AZ, we were $120,000 upside down at one point, today, we are about even. A few questions:

1. As I understand it, as long as we continue to make payments in accordance with the original terms, title will transfer to us (her) when those terms are satisfied. Is it correct to think we could sell the home in the same manner as any other homeowner?

2. While a refi may be out of the question; my name isn’t on the deed, and I can obtain a VA loan in another year, could I buy the property?

3. What possible damage can come from walking away or negotiating a DIL of foreclosure, if the lender isn’t reporting payments to the credit agencies?

As a side note, or employement, health and finances have improved considerably, and we reestablished credit by purchasing a new vehicle(over 30% equity) and obtaining unsecured credit cards in both our names with modest limits (Wells Fargo and Barclay) with balance of less than 3% of credit available, so I think we’ve done everything right, just can’t figure out this property maze.

Thanks for your time.

Ed

LikeLike

Hello Ed –

Regarding #1. Yes, you can continue to make payments in accordance with the original terms and the trust deed encumbering the title will be released when the referenced terms are satisfied. And yes, you can sell the home in the same manner as any other homeowner. It was only the Promissory Note that was Discharged in your Chapter 7. The trust deed continues to be attached to the property and is a matter of public record with the county clerk and recorder.

Regarding #2. Was the foreclosed property mortgaged with a VA Guaranteed loan or an FHA Insured loan? If not, once three years have elapsed from the date the foreclosed property was no longer in your name and two years have elapsed from the Discharge of your Chapter 7 you meet the basic criteria to qualify for a VA or FHA loan. Among the basic criteria are: acceptable credit, sufficient income and ability to pay. If the foreclosed property was either FHA or VA contact a lender in your area specialized in such loans. Not all understand how to deal with the complexities of what I reference as the Boomerang Buyer (watch my blog for an article on such).

Regarding #3. Read my blog titled Zombie Mortgage to get an idea of where you stand. Further, review my blog titled How long after bankruptcy or foreclosure must you wait to get a mortgage? to learn there is little, if any, time difference on ones “mortgage time out” be it Foreclosure, Short-Sale or Deed-In-Lieu (DIL) of Foreclosure. Keep in mind that it is not necessary for any of these derogatory actions to show on your credit report(s) as they are a matter of public record. One could further argue that it is acceptable for a mortgage servicer to report the mortgage as a Foreclosure, DIL or Settled so long as there is no attempt to collect a deficiency, if any.

Regarding Countrywide, that story is still being told. I will leave it to others to comment on their lending practices. Suffice it say that many good people believe their CEO’s name will live on in the annals of business infamy.

A couple of comments for clarification. I make these points not as an attorney but as an expert witness in matters such as yours. Once you file for bankruptcy, all of your assets and liabilities are listed. They become a part of the bankruptcy. You have no choice in this as you can’t discriminate against creditors by selecting to give preference to one over another. When a Chapter 7 is Discharged, all debts are Discharged unless reaffirmed. No specialized bankruptcy attorneys I know will counsel in favor of a mortgage reaffirmation. Your situation seems a good illustration of why.

Best wishes for success –

Jim

LikeLike

I’m confused, so if I’m discharged out of a chapter 7, but didn’t reaffirm my mortgage, yet it is FHA insured mortgage, I can qualify to streamline refinance it? Or even possibly a HARP?

LikeLike

Ricky –

For more information on your question see my post Refinance After Chapter 7? as this details the specifics of refinancing (not streamlining with your current servicer) with another FHA approved lender your FHA insured mortgage. The short answer is yes, you can refinance your FHA mortgage two years after your Chapter 7 Discharge.

Best wishes for success –

Jim

LikeLike

Hi there,

My wife and I live in Georgia and filed for Chapter 7 bankruptcy in July of 2010 and it was discharged in October of 2010. We did not reaffirm our mortgage because the lawyer advised us not to. Since then, we reaffirmed our car loan and have almost paid it off in full, have opened a few accounts to complete small home projects (Empire Carpet etc…) We paid those off in full. We have also been using small balance credit cards to make small purchases and pay those off in full as well. This is all being done to build our credit.

We didn’t reaffirm the mortgage, but we’ve continued to make the mortgage payments since the discharge. We’re now getting in the situation where we want to move. We owe 73,000 on the home, and we’re hoping to sell and walk away with money to put down on a new home. Would there be any reason we could not sell the home in the same manner that someone else without a bankruptcy would? The reason I ask is because we called Suntrust (our mortgage provider) about the steps we need to take about selling this house and purchasing another, but the loan officer wanted to make sure (since the bankruptcy) we wouldn’t run into title/deed trouble. Any advice?

Thanks!

LikeLike

Hello Colby –

Based on the information you provided, there should be no reason why you can’t simply list and sell your home as would anyone. So long as the property sells for at least as much as you owe, the only information needed from the mortgage servicer/bank/lender is your mortgage payoff. The buyer’s lender will obtain the payoff for the buyer. You will receive a release of the deed of trust subsequent to the closing.

Best wishes for your success –

Jim

LikeLike

Thanks James! That definitely puts me at ease.

LikeLike

We are currently trying to refinance our home after Chapter 7 Bankruptcy. We did not reaffirm on our mortgage. On July 13 the refi company we are going through ran our credit report and it showed that the mortgage company was not reporting our payments which was expected. But then on July 22 the refi company got a revised credit report showing all the payments recieved and one showing 30 day delinquent. By Law since we did not reaffirm they can not report current or delinquent payments can they? . I know for a fact there was not a reaffirmation or modification. Why I ask is because everything was a GO until they recieved the revised credit report, which seems a little fishy. The refi company is looking into it also because they feel as if something is not right. We are applying for a VA refi. Of course this all took place after the Banckruptcy Attorney we used went home for the day. It’s making me crazy and would appreciate an answer before tomorrow. Thank You

LikeLike

Hello Jack –

The answer is likely simple but before we can get there let’s first discuss the following: the mortgage company cannot report your payment history to the Credit Reporting Agencies (CRA’s). Your mortgage refinance person utilized a Rapid Rescore system and forced your payment history onto your mortgage credit report temporarily. This is all perfectly legal. This is also the only way a loan originator can get your mortgage credit payment history onto your merged mortgage credit report for underwriting purposes. By definition, this is a temporary report with a limited shelf life.

If you had a 30 day late payment in the last 2 years, your Rapid Rescore report would reflect such. This was not the mortgage company reporting your credit to the credit bureaus. This was your refinance professional forcing your mortgage credit onto the mortgage credit report. If you did not have a 30 day late payment, you will need to dispute this with your current mortgage service company.

I trust you find this information helpful to your mental health this evening. Let me know if I can be of further help.

Best thoughts and wishes –

Jim

LikeLike

Thank You so much for your Reply. I can rest easier now. The refi agent, which I realize now must not be very experienced or he is not honest will have some explaining to do tomorrow. Again, thank you for your help..

LikeLike

My pleasure. If you think of it, kindly let us know what you learn from your refi agent. Inquiring minds and all that.

LikeLike

Did a chapter 7 in 2008 and my mortgage was discharged. Did not readfirmed. It is now 2013 and I’m still fighting the foreclosure. Don’t ask me why, someone at Wells Fargo messed up. Mortgage has been sold multiple times. Sale date was issued and stopped it with a Chapter 13, making payments to Trustee of $1054.00. If my mortgage to Wells Fargo was discharged how can I be making payments through the trustee if there is no mortgage.

LikeLike

Hello Alberto –

If I understand what you are saying, the mortgage Note was Discharged in your 2008 Chapter 7 but you chose to voluntarily continue paying the mortgage payment. You may do this for so long as the Trust Deed remains in your name. This phenomena is described in my blog titled Living Underwater After Bankruptcy which you may wish to read. Is sounds as though sometime after your Chapter 7 you got behind on your mortgage payments and filed Chapter 13 to get caught up with those delinquent payments. You can do this but it will still not reinstate the Note which was Discharged in 2008 when you filed Chapter 7. Hopefully this helps with your understanding of what is going on with your mortgage.

Jim

LikeLike

Thank you for the reesponse James.

I did not make my case clear. My main question is why after a discharge without reffirming the home are they still trying to collect from me. The mistake was made by Wells Fargo in offering me a HAMP trial program after my mortgage was discharged which they then canceled and sold . The following assignees have been trying to foreclose and still asking for the amount of the mortgage plus all kind of lawyer fees and late fees. I feel this is a kind of harassment in violation of Bankruptcy laws. They should have proceeded with the foreclosure based on the fact that I did not reaffirmed. My chapter 13 lawyer should have seen this and brought it to the Bankruptcy Courts attension. For some reason today it all became clearer and realized that I should have brought this to the attension of the courts sooner. My attorney should have never gotten me into a payment squedule and instead realized that this has been a harassment case in trying to collect a discharged debt and so should the other attorneys hired before for foreclosure defense. What do you think about this predicament? And again thank you.

Alberto.

LikeLike

Mr. Valdes –

That which you need is legal help and I am not an attorney. You need to hire an attorney to help you sort this out. Email me privately via my website for a referral if needed.

Jim

LikeLike

Has anyone ever heard of a FHA insured loan that was not reaffirmed & dismissed in a Chapter 7 motion being streamlined 2 months after the BK dismissal date? Is that legal?

LikeLike

Yes, Micky, the streamline in available in the situation you describe providing the applicant has not defaulted on a Federal debt. This is pursuant to the CAIVRS Authorization system which lists any information regarding default, claim, judgment, or foreclosure reported on an applicant’s past government loans or guarantees.

I presume you meant to use the term Discharged as opposed to dismissed.

LikeLike

Interesting blog post. Do you mind if I put a link to it on my blog?

LikeLike

Yes, Attorney Haskell, you may link my blog with yours. Thank you for asking.

LikeLike

[…] a reaffirmation as it is of no benefit to the Debtor, only to the bank. As a result, I am sharing a blog post from James Spray a mortgage lender specialized in bankruptcy and mortgages in Colorado that I found interesting. I will say that it is usually […]

LikeLike

Mr. Spray,

Thank you for your informative posts. I have a situation that is somewhat unique. I filed for divorce in 2011 and finalized it in 2012. I “got” the house in the divorce. At the time the house value was about even or a little over the mortgage balance. My ex-wife signed a quit claim deed at that time. Per the terms of the divorce agreement, I need to either sell the home by September of 2014 or refinance the mortgage to get my ex wife off of the Wells Fargo mortgage. It is an FHA mortgage. During the divorce I lost my job and ultimately after my divorce was finalized I had to file for a Ch 7bk. The BK was finalized and discharged Feb 2013. Upon the advice of my BK attorney the Wells Fargo Home mortgage was not reaffirmed. (I don’t know why, as I would still have a legal liability to any negative repressions regarding the financial impact on my ex wife if I had left the house and it was foreclosed etc… I have almost 50K in equity now in the house and would like to stay longer term. I would like to re-finance and use the FHA Streamline Re-finance process. Wells Fargo has really not been much help. I greatly doubt is is a good idea to go back to the BK court to reaffirm.

Facts:

Primary Home purchase Joint with wife on title and Wells Fargo FHA mortgage: 5/28/2010

Current Home Value: $350,000

$285,000 Mortgage balance: FHA mortgage at Wells Fargo, 5 year arm, 3.375 till 2015

Mortgage: Me & ex-wife

Deed: Me and ex-wife* *divorce agreement says I received house, quit claim signed by ex giving home to me. Will not be filed until sale of home or re-finance!

ME: Home was NOT Re-affirmed at CH 7 BK and I was single when I filed BK

PER DIVORCE AGREEMENT: Must re-finance mortgage or sell by Sept 2014

Can I go to another lender and do an FHA Streamline Refinance there?

What other suggestions do you have?

Thanks,

Doug

LikeLike

Hello Doug – Kindly note my revised comment. I base this revision, in part, based on the observations of a knowledgeable reader, Krista Railey who wrote in part: “There is no mandatory waiting period following bankruptcy for a non-credit qualifying FHA streamline refinance, and reaffirmation of the mortgage is not required.”

Documentation required: [1] Obtain the most recent 12-month payment history from your mortgage. [2] Your mortgage originator will use these with a credit rescoring system to put the history on your credit report for the purposes of the streamline refinance. [3] Provide a copy of the divorce order, the financial separation agreement and child support orders (if any). [4] Finally provide a copy of your bankruptcy documents including the Discharge.

One issue to be aware of is this: Although your bankruptcy has been Discharged, the bankruptcy case itself may not have yet been closed by the Chapter 7 Trustee. Contact your attorney’s office to make sure your case has been closed. If not, discuss with your attorney possible solutions to get the case closed.

Given you have an FHA mortgage, and given you have had no 30 day late payments on the mortgage since filing the bankruptcy and preferably never, per the record keeping system (CAIVRS) unique to FHA, VA and USDA you can refinance. This includes the FHA Streamline Refinance program provided you otherwise qualify. At that time, I suggest you wish to contact an experienced mortgage originator in your area that knows FHA Streamline and Bankruptcy. On this, I suspect you can find a reputable lender who is a member of National Association of Mortgage Brokers will be able to assist you.

Thank you, Ms. Railey. You were most helpful!

My best wishes for your success. Please let us know how this turns out for you.

Jim

LikeLike

Hi James,

I enjoy your blog, but I wish you had given Doug better advice.

A transfer that is due to divorce does not trigger the due-on-sale clause; see 4155.1 6.C.3.c. When a party is deleted from title due to divorce, and the remaining owner occupied mortgagor can show 6 months satisfactory payments since the transfer, a credit qualifying FHA Streamline refinance is not required. In such instances, the borrower would be able to complete a non credit qualifying streamline refinance.

There is no mandatory waiting period following bankruptcy for a non-credit qualifying FHA streamline refinance, and reaffirmation of the mortgage is not required. It should have been explained that if he wanted to complete a non-credit qualifying streamline refinance, he would have to provide a certified copy of the quit claim and deposit the original with the title company for recording at closing. He would also need to provide evidence that he has made the last 12 months mortgage payments in the same month due to evidence a satisfactory mortgage history.

Doug should request a 12-month payment history from his mortgage servicer because the history will not be reported to the credit bureaus. Doug should also provide evidence that he has made the payments from his account since the date of transfer or for a minimum of 6 months. In regard to the quit claim not being recorded, the lender should go by the execution date because properly executed deeds do not be recorded to be valid. Recording just provides public notice.

Doug’s big issue in regarding FHA streamline refinancing is the date of the mortgage. The 2010 mortgage insurance premiums were lower, and the mortgage insurance would increase if he were to refinance due to the higher current premiums. In his situation, he might have to streamline into a 5/1 ARM in order to meet the net benefit requirements for FHA streamline refinancing depending on his current interest rate.

Please advise Doug that he should provide a copy of the divorce decree awarding him the house, a copy recorded of the quit claim or grant deed, evidence of 12 months satisfactory payments, and evidence that payments have been made from his account for a minimum of six months to a qualified lender in his area.

Thank you,

Krista Railey

LikeLike

Thank you, Ms. Railey. I value your comments and correction. Mea Culpa, I haven’t done a Streamline since 2006 and had to revisit Chapter 6 of 4155.1 to refresh myself. Again, thank you!

Best thoughts.

Jim

LikeLike

Mr. Spray,

I hope you can help with my current situation.

Filed for Chapter 7 in 2012 and it was discharged in May 2013. Primary mortgage was not reaffirmed, but we continue to make the payments. A junior lien was stripped during the Chapter 7 discharge.

Thinking we could do an FHA re-fi after 2 years post-BK, I have been working with a broker and everything was going fine until he pulled my credit report and asked about the second mortgage that was stripped. He thinks the lenders he’s working with will not underwrite a loan now because of this.

Can you explain please what the provisions are for refinancing a mortgage in my situation? Is a longer seasoning period required? What else must we do before we can refinance?

Thanks.

Beth

LikeLike

Hello Beth,

You’ll need to provide the lender with the Order stripping the second mortgage so the property title can be cleared. Short of the Court Order to strip the lien from the property title, the lien will remain on the title until it is settled. Provide the lender with said Order and you should be able to proceed. There is often confusion between the lien and the note. Unless reaffirmed, the note was discharged as a part of the Chapter 7. Unless the lien was specifically ordered to be stripped, it is still attached to the title to the property.

We observe that it has been very rare for a second mortgage to be stripped in Chapter 7 while it has been common in certain Chapter 13’s.

If there was not a specific order stripping the lien, the lien will have to settled in order to sell or refinance the property.

Should you determine the lien is still attached to the property, you may wish to read: A Bankrupted Second Mortgage Can Foreclose

Let us know what you learn and know that our best wishes are with you!

Jim

LikeLike

[…] reaffirmation as it is of no benefit to the Debtor, only to the bank. As a result, I am sharing a blog post from Attorney James Spray in Colorado that I found interesting. I will say that it is usually […]

LikeLike

Thank you, Attorney Haskel, for the high compliment. For the record, I am not an attorney. I am an expert witness on matters of bankruptcy and consumer credit with a heavy slant toward mortgages as I’ve been originating mortgages for 40 years this month. I have niched in refinancing folks both during and after Chapter 13 repayment Plans as well as following Chapter 7 Discharge.

Respectfully,

Jim

LikeLike