Am I a Fact or a Myth

Myth – The more money you have or earn the better your credit scores.

Fact – One can be incredibly wealthy or high paid and still have not good credit scores. Your credit scores do not reflect your income or assets. Your credit scores reflect your wise use and management of credit or not.

Myth – Cell phone, cable and Internet companies all regularly report payments to the credit bureaus.

Fact – They only time you can count on these service providers to report to credit bureaus is when you do not pay them.

Myth – Marrying someone with lower credit scores than yours will lower your own credit scores.

Fact – That is simply not true. What is accurate is that if you open new joint credit accounts which are not paid on time or become abused this will reflect against both of your scores. This is simply co-signing for debt or as we call it committing financial “suicide by pen.”

Myth – Credit has nothing to do with your relationships or love life.

Fact – A good credit score is now considered sexy and bad credit can break a romance.

Myth – Your credit history is erased when you file bankruptcy. This is part of your Fresh Start in life.

Fact – When you file bankruptcy your creditors are to list your account as being in bankruptcy. Most creditor history is shown on your credit reports for 7 years. In the case of bankruptcy it can show for up to 10 years. In the case of judgments not discharged in bankruptcy these may show for up to 20 years. Errors can be corrected or deleted from your credit reports.

Myth – Creditors always play fair and credit reports report correct information only.

Fact – There are those creditors that simply do not play fair. The key rules for playing in the creditor and debt collection sandbox are the Fair Credit Reporting Act (FCRA), the Fair and Accurate Credit Transactions Act (FACTA) and the Fair Debt Collections Practices Act (FDCPA). The sandbox monitors are consumer protection attorneys. Yes, a consumer is empowered by the Federal Trade Commission to correct errors but has almost no chance against the creditors or credit reporting agencies. Use great caution when doing this as you can do more yourself harm than good with a wrongly worded argument. Keep the Miranda Warning, so to speak, in mind as you write as anything you say can and will be used against you.

Myth – There are incorrect addresses listed on my credit report and this is why my scores are so low.

Fact – These are simply clerical errors and do not reflect on your credit score whatsoever. Verily these are a nuisance but it may be more trouble to prove you never lived at a certain address than it’s worth in the time and energy invested. If you wish to dispute the errors, I suggest you read Credit Repair Basics.

Myth – All credit inquiries reflect against your credit score.

Fact – That is simply not true. The Social Security Administration has a great explanation for ‘soft’ credit inquiries: “Soft inquiries do not affect your credit score, and you do not incur any charges related to them. Soft inquiries are displayed in the version of the credit profile viewable only to consumers and are not reported to lenders. The soft inquiry will not appear on your credit report from Equifax or Transunion [or Experian], and will generally be removed from your credit report after 25 months.”

Myth – Cable/internet, utilities and cell phone accounts are regularly reported to credit bureaus.

Fact – These type of accounts are not regularly reported to the credit bureaus. The only time they are reported is when collection activity begins after payments haven’t been made.

Myth – All credit scoring companies are the same as are the scores they provide.

Fact – Companies that sell credit scores do not sell credit scores used by most lenders. See FICO or FAKO Scores?.

Myth – It’s fine to run a high credit utilization each month as long as you payoff the entire balance at the end of month.

Fact – On credit utilization anyone who uses credit cards could have high utilization, particularly those which pay off their balances in full each month. This is because balances are often reported to the credit bureaus mid-billing cycle. So if you have a $5,000 limit and you charge $4,000 in a month, you could be reportedly utilizing 80% of your available credit. The result is most often dramatically reduced FICO™ Scores.

As always do not hesitate to write back with comments or questions. I read everything that comes back, even though I don’t always get a chance to respond as quickly as I would like.

Image attribution

Financially Speaking™ James Spray, RMLO, CNE, FICO Pro

CO LMO 100008715 | NMLS 257365 | November 7, 2010 | Rev. April 3, 2014

Notice: The information on this blog is opinion and information. While I have made every effort to link accurate and complete information, I cannot guarantee it is correct. Please seek legal assistance to make certain your legal interpretation and decisions are correct. This information is not legal advice and is for guidance only. You may use this information in whole and not in part providing you give full attribution to James Spray.

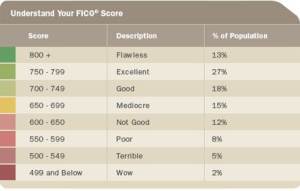

How much does missing a payment impact a FICO® Score? What about reducing credit card balances? New FICO research simulated how different credit events may impact FICO® Score 9 for five different credit profiles, as seen in Figure 1 below. These representative profiles were selected because they had credit characteristics (payment history, utilization, etc.) that were generally typical of the five scores shown below.