This post is written for folks currently in a Chapter 13 Plan. It is also helpful for those contemplating filing a Chapter 13 Bankruptcy Reorganization Plan. This post is also helpful for those recently Discharged from Chapter 13. A mortgage refinance or a home purchase, while still in a Chapter 13 bankruptcy, is possible; it is also a complicated financial and, legal transaction. To do this requires a highly specialized mortgage professional experienced with both FHA lending rules and Chapter 13 bankruptcy as well as local court rules.

The Chapter 13 Payment

One of the most important things to understand is the importance of on-time Chapter 13 Payments to the mortgage underwriting process. I strongly encourage you to read this: The Chapter 13 Payment. Your Chapter 13 Trustee payment is given the exact consideration as your housing (mortgage/rent) payment in underwriting. From the underwriting perspective, one thirty-day late payment of either the mortgage or Chapter 13 Trustee payment will sink your prospects of getting mortgage loan approval for at least a year. Mail your payment early or set your on-line bill pay or direct payment to the Trustee so that you always know your payment has had time to get to the Trustee’s office and be posted by the staff at that office. Too many times, on review of the Chapter 13 Payment history, we find a payment was posted on the 2nd day of the month. One day counts as a late payment. An experienced mortgage lender can help you check your Chapter 13 payment history in real time.

Mortgage Choices for Chapter 13 Debtors (purchase or refinance)

The only mortgages available, either for refinance or purchase, for those in a Chapter 13 Plan are those insured or guaranteed by the Federal government. These mortgages are either: insured by FHA, guaranteed by VA or the USDA. Each

of these home loans are underwritten with the same guidelines as set forth in the FHA Handbook. How does a bankruptcy affect a borrower’s eligibility for an FHA mortgage? From the FHA Handbook: “A Chapter 13 bankruptcy does not disqualify a borrower from obtaining an FHA mortgage provided the lender documents that one year of the payout period under the bankruptcy has elapsed and the borrower’s payment performance has been satisfactory (i.e., all required payments made on time). In addition, the borrower must receive permission from the court to enter into the mortgage transaction.*” Most underwriters will consider the Chapter 13 Trustee’s approval as permission from the court.

Application to Incur New Debt

To get underwriting approval for a Chapter 13 Debtor to refinance the Chapter 13 Trustee (in Colorado) or the Judge must approve your application to incur new debt. Contact your attorney to determine how and when to best proceed, or not. There are situations when it may not be in your best interest to purchase or refinance while in Chapter 13. This is a process which you can only do with the advise and assistance of your attorney. Your attorney must prepare the financial statements to submit to the Trustee in order for authority to be granted for a lender to offer new credit. Your mortgage loan originator should be able to assist your attorney in completing the Application to Incur New Debt.

Mortgage Refinance After Chapter 13 Discharge?

Yes. One may refinance or purchase within 2 years following the Discharge. BUT, it is easier to get approved for a mortgage while still in Chapter 13. This is because, following Discharge, a manual underwrite is mandated. Few lenders are willing to take the risk of not having the safe harbor provided by Automated Underwriting. Begin reestablishing good credit as soon as your Chapter 13 Plan is confirmed and continue this discipline while your case is still open so by the time your Discharge enters, you have solidly reestablished good credit.

Two years following Discharge, with reestablished credit, one may qualify for a conventional or Qualified Residential Mortgages (QRM) to purchase or refinance a home loan.

Preliminary Requirements for Purchase or Refinance While in Chapter 13

- Twenty-four months of current housing payments with no 30-day late payments and, the likelihood of the income continuing for at least three years.

- Two years IRS Returns showing your income is sufficient to pay the mortgage as well as your Chapter 13 payment and any debt not included in the bankruptcy payment.

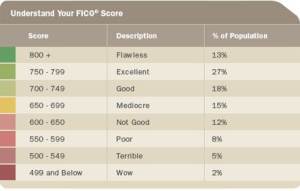

- Minimum middle FICO Score of 620 . Most will need to practice what I’ve previously posted as FICO 101a, 101b and 101c for several months prior to making a successful application for mortgage credit.

- For anyone with a fear of having credit make time to read both Credit: Use It to Build It (Part 1) and Credit: Use It to Build It (Part 2).

- Begin rebuilding your credit as soon as your Chapter 13 Plan is Confirmed/Court Approved; this is when your property has been revested to you.

- The maximum limited-cash out loan to value on an FHA appraisal is presently 95% – Refinance.

- The minimum down payment is 3.5% of the purchase contract or appraised value whichever is less. – Purchase

- The maximum Debt to Income Ratio is 45%. This is pushing the envelope. While in Chapter 13, it is mandatory to have Court approval (in Colorado, the Trustee approval suffices) to obtain a mortgage.

There is more detail to this process than can reasonably be discussed herein but this is the essence of purchasing or refinancing while in Chapter 13.

*Reference: FHA Handbook 4000.1 II.A. 5.a.iii (H)(2)(3).

Disclaimer: This article does not represent that any of the information provided is approved by HUD or FHA or any US Government Agency.

Bankruptcy Seal image attribution Model T image attribution Financially Speaking™ James Spray, RMLO, CNE, FICO Pro | CO LMO 100008715 | NMLS 257365 | November 1, 2010 – Revised May 2, 2018 | Copyright 2010-2018

Financially Speaking™ James Spray, RMLO, CNE, FICO Pro | CO LMO 100008715 | NMLS 257365 | November 1, 2010 – Revised May 2, 2018 | Copyright 2010-2018